Homeowners Insurance in and around Huntington

If walls could talk, Huntington, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

Would you like to create a personalized homeowners quote?

- Huntington, IN

- Roann, IN

- Wabash, IN

- Andrews, IN

- Peru, IN

- Fort Wayne, IN

With State Farm's Insurance, You Are Home

Your home and property have monetary value. Your home is more than just a roof and four walls. It’s all the memories you’ve made there. Doing what you can to keep your home protected just makes sense! That's why one of the most sensible steps is to get excellent homeowners insurance from State Farm.

If walls could talk, Huntington, they would tell you to get State Farm's homeowners insurance.

The key to great homeowners insurance.

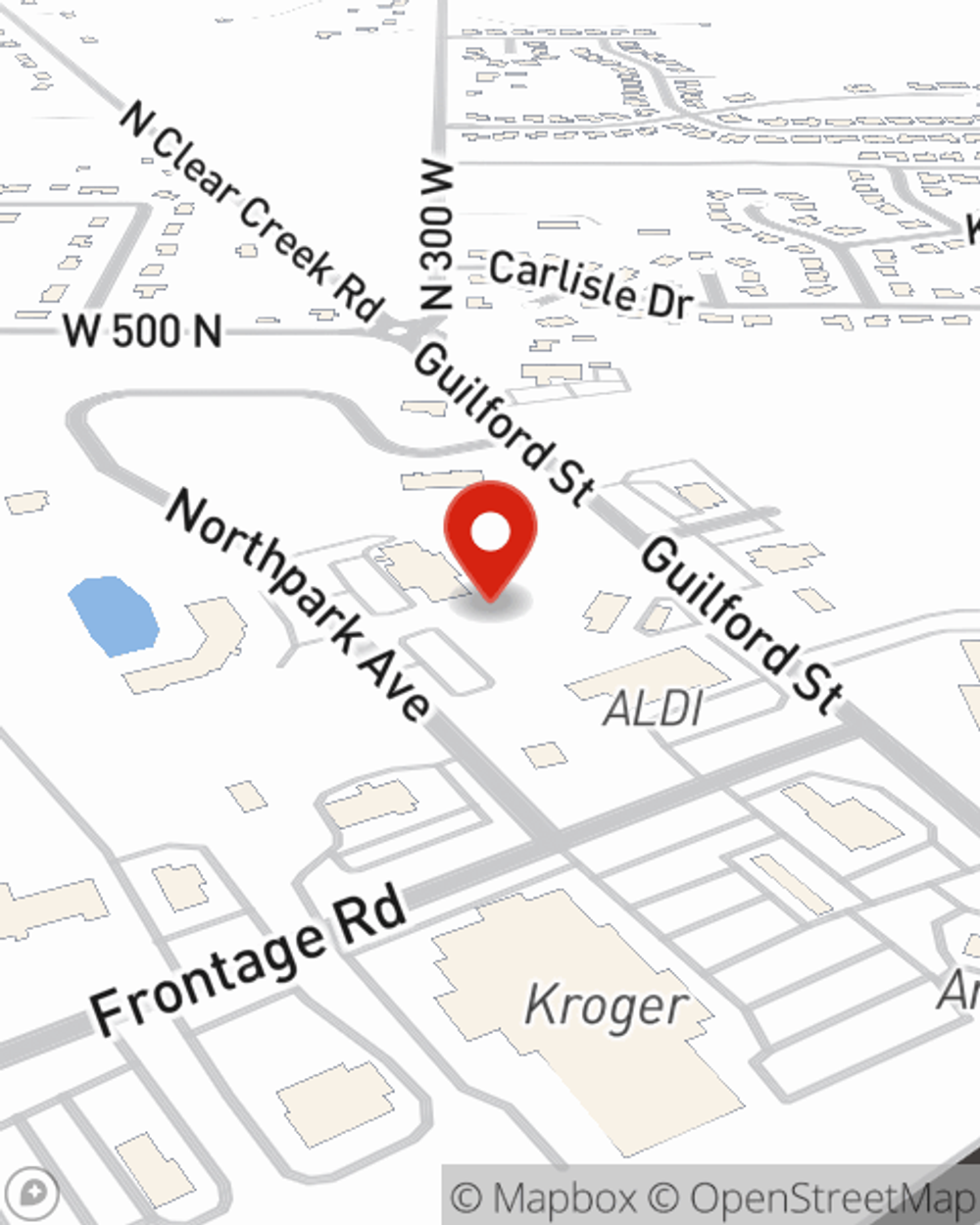

Agent Eileen Mcmillan, At Your Service

State Farm's homeowners insurance protects your home and your memorabilia. Agent Eileen McMillan is here to help build a policy with your specific needs in mind.

Don't let your homeowners insurance go over your head, especially when the unpredictable takes place. State Farm can bear the load of helping you figure out what works for your home insurance needs. And if that's not enough, bundle and save could be the crown molding to your coverage options. Contact Eileen McMillan today for more information!

Have More Questions About Homeowners Insurance?

Call Eileen at (260) 356-5222 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.

Eileen McMillan

State Farm® Insurance AgentSimple Insights®

Pros and cons of buying a condo

Pros and cons of buying a condo

Thinking about buying a condo? Take a look at this list before you make the big decision. It’ll help you weigh the pros and cons of condo living.

How to use public Wi-Fi safely

How to use public Wi-Fi safely

When using a public Wi-Fi access there can be risks involved. We’ve provided some steps to help protect your information.